Perspectives

| Dec 18, 2024

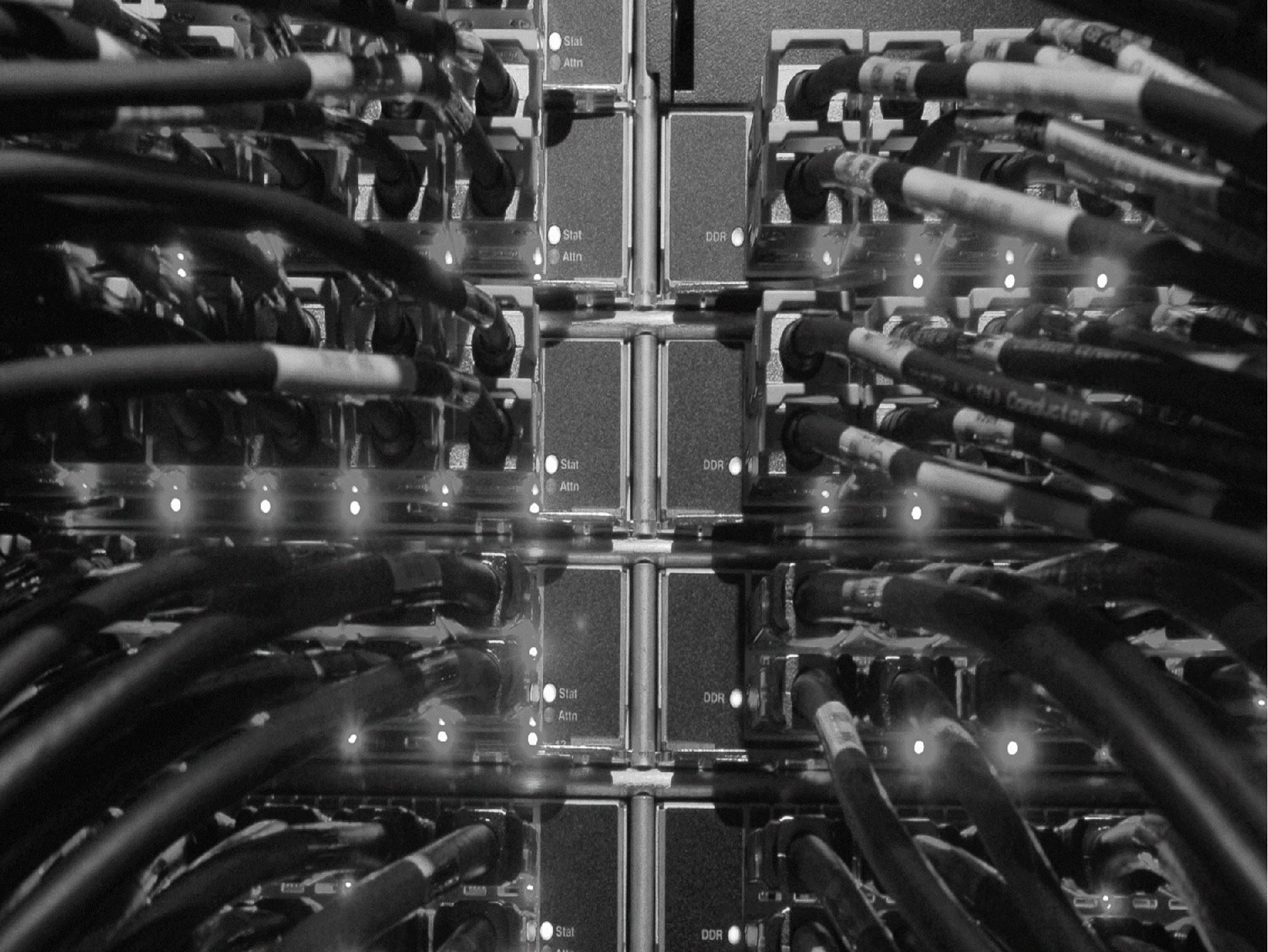

Investing in AI Infrastructure: Data Centers of the Future

By Aidan McKeown, Portfolio Manager, and Alan Shaffran, Partner and Senior Portfolio Manager

In this paper, we explore the highly private bank regulatory capital transactions, specifically the Significant Risk Transfer (“SRT”) market that grants investors access to tap into a wide variety of exclusive on-balance sheet bank loans. We find that the current market environment, with the benefit of rising floating interest rates and banks issuing SRT transactions in large scale to maintain stable capital ratios, arguably represents a favorable fact pattern for SRT transactions that result in wider spreads/margins on investments than at any other time in the last five years.

Please fill out this form and we will connect to provide you with access to: A Primer on the Regulatory Capital/SRT Market.

You will receive an email confirming your request to access: A Primer on the Regulatory Capital/SRT Market.

Thank you for your interest in our perspective insights, please submit your information below to request access.

Thank you for your submission! Once approved, the requested pdf will be sent directly to the email address provided.